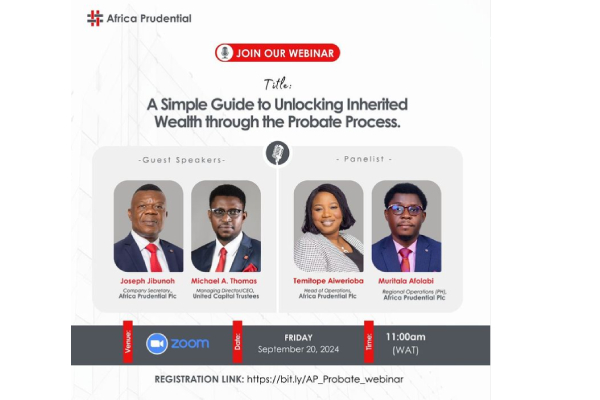

Michael Abiodun Thomas Speaks on The Role of Trustees in the Probate Process.

Recently, Michael Abiodun Thomas, MD/CEO, United Capital Trustees featured as a Guest Speaker on a Webinar hosted by Africa Prudential Plc themed: “A simple guide to unlocking inherited wealth through probate process”. The webinar aimed to demystify the probate process, often perceived as the complex process of claiming inheritance from a deceased benefactor. Probate is the legal process of validating a will and distributing a deceased person’s assets.

Speaking alongside other industry experts, Michael discussed the steps involved in probate, particularly when a will is available and when a person dies intestate (without a will). He emphasized the importance of estate planning, highlighting its benefits for both individuals and future generations. In addtion, he identified the common challenges faced in estate planning and recommendations for mitigating them.

- Drawing up a will is not a death warrant; it gives you control over your legacy, ensures that your loved ones are taken care of and helps avoid confusion and potential conflicts among beneficiaries.

- Being a next of kin does not automatically guarantee inheritance from an estate. You must be specifically mentioned as a beneficiary in the deceased’s will to be eligible.

- Assets are not limited to money alone, it could include real estate, Investments (such as stocks, bonds, mutual funds), Intellectual property (patents, copyrights, trademarks), Retirement savings accounts, Personal belongings, etc. A comprehensive estate plan ensures that all your assets are accounted for and distributed according to your wishes.

- Select an executor or administrator with a proven track record of excellence and transparency. The executor/administrator is responsible for carrying out the instructions in your will. Consider selecting a professional executor, who can provide expert guidance and ensure that your estate is managed efficiently.

- Develop a comprehensive estate plan that includes a will, trusts (such as education trust for your children or beneficiaries) medical power of attorney etc, and other relevant documents. A well-structured estate plan can help minimize legal complexities and ensure that your wishes are carried out.

- Be Intentional about life and growing your assets which can provide greater financial security for your beneficiaries. Take advantage of various strategies for growing your assets, such as saving, investing, and reducing debt.

- Clearly plan and outline how the assets will be distributed amongst beneficiaries. If you have minor children, consider creating a trust to manage their inheritance until they reach adulthood.

- Exploring the benefits of trusts gives you a wholistic view of your assets, protects your assets from creditors and lawsuits, keeps your affairs private, avoids probate which could be a time-consuming and costly legal process, and prevents disagreements among beneficiaries.

- For business owners, a business succession plan makes provision for ownership and management upon demise. A well-crafted plan ensures a seamless transition and sustainability of the business.

The webinar featured other experts from Africa Prudential such as Joseph Jibunoh,